Comparing Voluntary and Regulated Carbon Markets

Two different market-based approaches exist to set a price on carbon and push companies to decarbonize.

Companies considered high-polluting, fall under the Regulated Carbon Market and are subjected to a CO₂ emissions quota. All companies can also voluntarily contribute to projects avoiding or capturing carbon emissions to account for their own footprint.

- Created after the Kyoto Protocol in 1997, the Regulated Carbon Market sets a limit on the number of tonnes of CO₂ heavy polluters can emit. Carbon allowances can be sold by companies which did not exceed their quotas and bought by those which have exceeded their cap.

- Initiated under the UNFCCC in 2000, the Voluntary Carbon Market allows organizations and individuals with CO₂ emitting activities to take voluntary climate action by privately contributing to certified carbon removal and avoidance projects.

For more information on Carbon Removal Methods, download the guide. Both markets were designed to set a price on carbon, but they function differently. The object of this article is to compare their main characteristics.

Different Market Structures Between the Regulated Carbon Market and the Voluntary Carbon Market

The Regulated Carbon Market

The structure of the Regulated Carbon Market is based on a ‘cap and trade’ system. A number of quotas is allocated to the regulated companies and can be exchanged between the market players. The total number of quotas allocated represents the market cap. The list of companies is defined by the European Union. One quota is equivalent to one tonne of CO₂ and regulated companies can sell or buy quotas between them to comply with their limit.

It is a regulated market: the quota price depends on offer and demand. Government-supervised registries and non-compliance penalties have been implemented to ensure compliance and transparency. For instance, in the case of the European Union Emission Trade Scheme (EU ETS), the common European Registry has been implemented and a penalty of €100/t has been set. Storage of quotas is also authorized, but only under governmental monitoring.

The Voluntary Carbon Market

In contrast, the Voluntary Carbon Market operates on a more flexible basis. This is an over-the-counter market where companies and individuals can buy carbon credits issued by certified projects, often as part of voluntary initiatives. The price of credits in this market is more variable and depends on many factors, such as the location of the project, the environmental and social co-benefits it generates (such as biodiversity or community development), and the certification standard (e.g. Gold Standard or VCS). These features make the Voluntary Marketplace an attractive mechanism for organizations seeking to go beyond their regulatory obligations.

The lack of transparency in some Voluntary Carbon Market transactions may undermine the credibility of carbon credits, but efforts are underway to improve traceability and ensure that each credit corresponds to a genuine reduction or sequestration of emissions. These initiatives are aimed at boosting confidence in the market and attracting more companies and individuals keen to make a voluntary contribution to the fight against global warming. At ClimateSeed, we are committed to transparency and the strict selection of quality projects.

For a deep-dive on this topic, be sure to watch our webinar: From Carbon Offsetting to Climate Contribution.

Different Levers for Decarbonization

The Regulated Carbon Market

First, the cap-and-trade system pushes companies to decarbonize as it sets a limit on the polluting capacity of regulated companies. Second, since 2012 the number of freely allocated quotas has been progressively reduced. Some industries operating within the Regulated Carbon Market need to buy quotas to pollute: it is the polluter pay-principle.

To buy these quotas, auctioning rules have been implemented. By 2034, all quotas in the market will be auctioned meaning that for every tonne of carbon emitted within the EU from regulated companies, a carbon price will apply.

The Voluntary Carbon Market

The carbon reduction projects on the Voluntary Carbon Market avoid or capture CO2 emissions. They are classified under several project typologies, such as forestry & land use, renewable energy, household community devices and water management, agriculture and waste management.

International standards (Gold Standard, VCS, etc.) set guidelines and methodologies to certify projects, which are assessed by independent third parties. Organizations thus choose projects most aligned with their environmental and social goals.

Main Advantages and Limitations of the Regulated Carbon Market and the Voluntary Carbon Market

The Regulated Carbon Market

The Regulated Carbon Market is a powerful climate policy tool. All participants are obligated to comply with its rules. As soon as the price of carbon is high enough, as it is the case now, companies are pushed to find faster ways to decarbonize. Decarbonization becomes a cost-saving measure.

The two main limits of this market today are the carbon allowances surplus and the leakage risks.

- A surplus of quotas means that there is an excessive amount of allowances available on the market pushing the price of the carbon permits down.

- Leakage occurs when companies flee to countries with no carbon market regulations to avoid the polluter-pay principle. As a result, countries that are not subjected to such a scheme could attract companies that fear for their competitiveness.

The Voluntary Carbon Market

Whereas the Regulated Carbon Market does not facilitate the financing of climate friendly projects, the Voluntary Carbon Market does. Besides the carbon avoidance or capture, the projects also generate other positive environmental and social impacts linked to the United Nations Sustainable Development Goals, such as gender equality, life-on-land protection, or education.

The Voluntary Carbon Market valuation reached $2Bn in December 2021 as an increasing number of companies commit to net-zero targets and aim to meet the Paris Agreement’s goals.

However, lack of transparency and poor communication could hinder the development of this market.

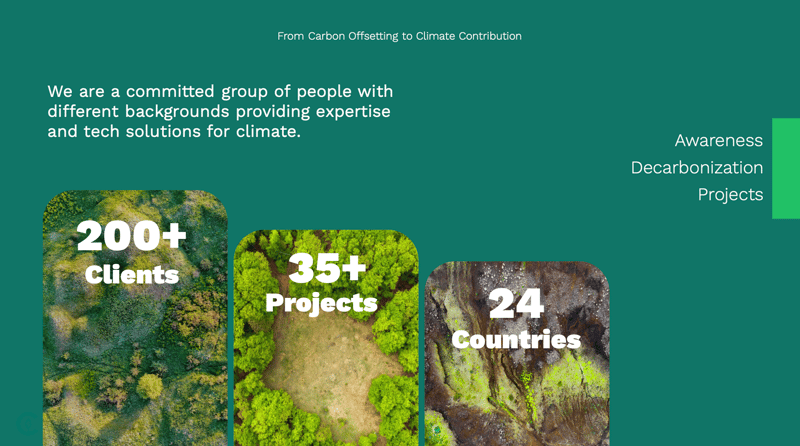

About Climateseed

At ClimateSeed, we support our customers in measuring and reducing their carbon footprint. We also maintain strong relationships with project developers implementing recognized projects on the Voluntary Carbon Market, to offer our customers a portfolio of high-quality projects, enabling them to decarbonize outside their own value chain.

FAQs

Carbon sequestration and avoidance projects financed on the Voluntary Carbon Market offer numerous co-benefits beyond the reduction of greenhouse gas emissions. Here are just a few examples:

Environmental benefits: These can include preserving biodiversity, restoring ecosystems and improving air and water quality. For example, reforestation projects create habitats for flora and fauna.

Economic benefits: These projects can generate local employment, often in rural or developing regions, by supporting activities such as sustainable forest management, agroforestry or renewable energies.

Social benefits: Projects can improve the living conditions of local communities, by facilitating access to clean energy, drinking water or supporting more sustainable agricultural practices, thereby strengthening food security.

Health benefits: By reducing air pollution or promoting healthier lifestyles (e.g., through improved cooking stoves), projects can have a direct impact on the health of local populations.

These co-benefits reinforce the overall impact of projects, aligning the fight against climate change with sustainable development objectives. Contact us to find out more about our project portfolio.

The Voluntary Carbon Market is experiencing strong growth for several key reasons:

Increasing pressure on companies: Companies are under increasing pressure to integrate sustainability strategies, driven by consumer and investor expectations and new regulations. They are seeking to reduce their carbon footprint by supporting projects that capture or avoid greenhouse gas emissions.

Global climate commitments: International agreements, such as the Paris Agreement, are pushing governments, companies and organizations to take action to limit global warming. The Voluntary Carbon Marketplace makes it possible to support initiatives that contribute to these goals by financing environmental projects.

Growing demand for high-quality carbon credits: Demand for certified credits, guaranteeing credible and measurable emissions reductions, has risen sharply, boosting confidence in the market.

Innovation and diversification of projects: The types of projects financed are diversifying, including not only reforestation but also technologies such as direct carbon capture or renewable energy initiatives, thus attracting more investment.

Adherence to ESG objectives: Many companies are committed to ESG (Environment, Social, Governance) strategies, and financing carbon projects is an important lever for meeting their commitments to reducing environmental impacts.

These factors are contributing to the rapid and sustained growth of the Voluntary Carbon Market.

The Voluntary Carbon Market has several major advantages:

Flexibility for companies: It allows companies to choose specific projects to support, according to their priorities and objectives. This gives them greater flexibility to reduce their carbon footprint while aligning their actions with initiatives that correspond to their values and strategies.

Support for high-impact projects: The market finances projects that capture or avoid emissions, often in regions of the world that would not otherwise have access to financing. These projects, such as reforestation, sustainable land management or clean energy, also contribute to local development, with environmental, social and economic co-benefits.

Accelerating the low-carbon transition: By enabling companies and individuals to finance emission-reduction projects, the Voluntary Marketplace helps accelerate the transition to a low-carbon economy.

Innovation: The market encourages innovation by supporting new technologies and solutions to capture or reduce carbon emissions, such as carbon capture and storage (CCS) or renewable energies, thereby strengthening long-term climate resilience.

Complement to government regulations: The Voluntary Marketplace offers an alternative or complement to regulated markets, enabling companies that are not subject to legal obligations to participate actively in reducing global emissions.

Transparency and credibility: Thanks to strict standards and certifications, the Marché Volontaire guarantees that the projects financed are of high quality, measurable and verifiable, thereby reinforcing the confidence of investors and participants alike.

These advantages make the Voluntary Carbon Market a valuable tool in the fight against climate change, facilitating positive-impact actions and mobilizing resources for sustainable solutions.

Share this

You May Also Like

These Related Stories

The difference between carbon removal & carbon avoidance projects

Understanding Afforestation, Reforestation, & Revegetation (ARR) projects