Why Purchase Carbon Credits as Part of Your Net-Zero Strategy?

Certified carbon projects enable your company to take meaningful responsibility for its emissions while actively supporting global climate goals. Go beyond carbon reduction and deliver valuable co-benefits, such as protecting ecosystems, creating jobs, and empowering local communities.

Our Support

We help with building a customized carbon credit portfolio that combines high integrity with strong co-benefits.

Align Your Climate Ambitions with Verified Action

Our experts select among our 50+ verified projects to deliver impact, match your climate ambitions, and align with your climate strategy. We define and understand your needs, including impact type, financing options, budget, and timeline, to provide you with a customized climate contribution portfolio.

Our service includes

Understanding your Net-Zero Commitments to achieve them.

Assessing your budget for a customized climate portfolio.

Aligning impacts & SDGs to your strategy.

Prioritizing impact type (carbon removal & avoidance).

Targeting geographic focus.

Defining timeline & contract: such as ex-ante or ex-post credits.

Mitigating portfolio risk by carefully selecting projects that align with each company’s climate strategy and deliver measurable impact, underpinned by rigorous due diligence and verification processes.

Strategic Carbon Portfolios for Sustainable Climate Impact

Our experts work alongside you to design a diversified portfolio of high-quality climate projects. This portfolio approach reduces risks, enhances credibility, and maximizes impact.

By integrating this strategy across your value chain, you complement emissions reduction efforts and reinforce your broader sustainability goals. This allows you to take meaningful responsibility, while contributing to global climate goals.

Our customized approach includes

Enhance Communication Efforts

Effective communication in the carbon industry is crucial for building trust, ensuring transparency, and aligning stakeholders on climate goals. It helps bridge the gap between carbon methodologies and public understanding, by enabling informed decisions that lead to credible climate action.

Our support includes

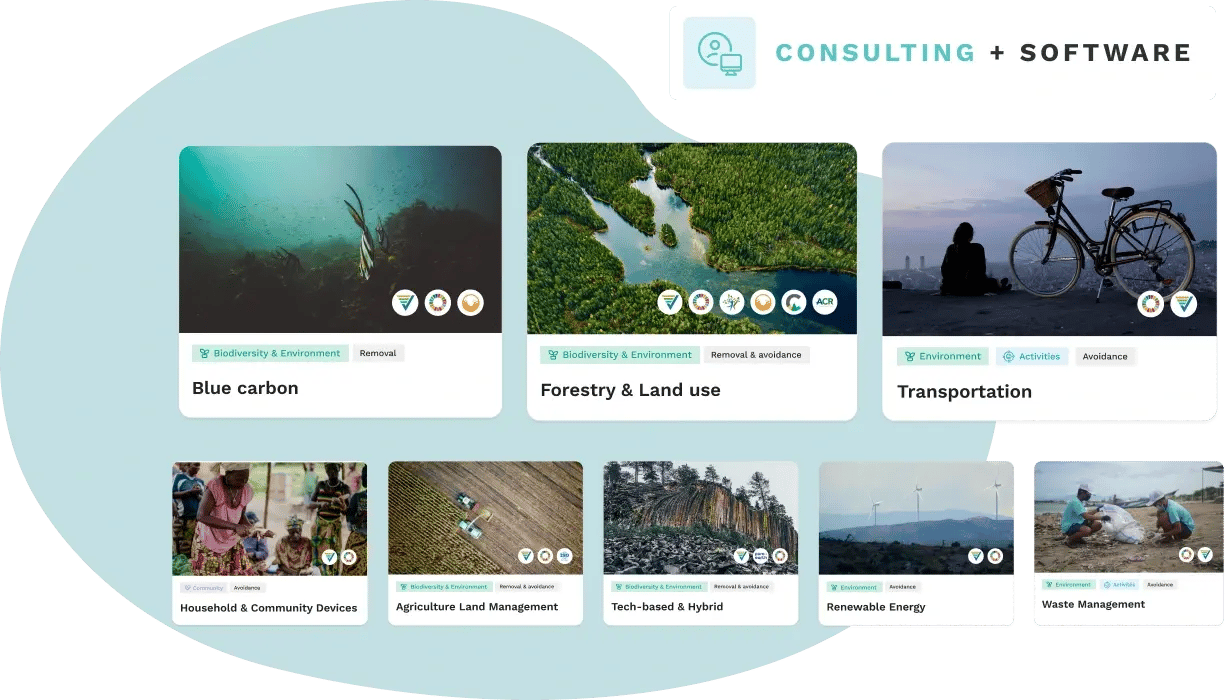

Discover our carbon projects portfolio

Explore how our high-quality projects can support your net-zero strategy and help you manage your climate contributions with transparency.

Standards

Our Added Value

Discover what makes us unique through our strengths, along with our

risk mitigation and project selection process.

Proven Expertise

Our team stays at the forefront of market developments, methodology revisions, and evolving regulations.

High-Quality Carbon Credits

Our experts not only carefully select each project, but also continuously monitor them to mitigate risks. We maintain close, long-term collaborations with project carriers.

No Secondary Carbon Market

We avoid speculation and the resale of credits. We work directly with project carriers, reducing intermediaries and maximizing the impact for projects and local communities.

Transparent Business Model

We ensure full transparency from project selection to financial contribution and carbon credit retirement through the use of a secure digital platform.

Risk Mitigation

Our experts apply a three-level due-diligence process, including initial project screening, banking due-diligence, and a thorough project review through our evaluation framework.

Clear Margins & Fair Prices

Prices are set by project carriers, with a fixed 15% margin to cover all operational costs required to deliver the highest-quality projects.

They Trust Us

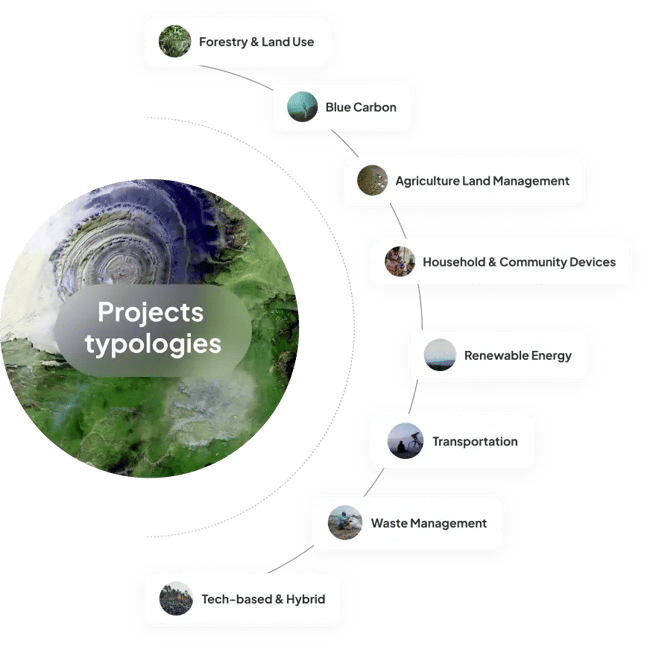

Our Carbon Project Typologies

ClimateSeed’s customized portfolio is composed of various typologies, those of which are categorized below.

Nature-based Solutions (NbS)

Household & Community Devices

Energy, Industrial & Circular Economy

Hybrid & Engineered Solutions

4 M

Carbon Credits Available

4

Main Project Categories

50+

Projects Available

17 SDGs

Targeted

Learn More about our Projects & Project Visits

Explore our projects on the ground that showcase real impact & collaboration.

Impact Type

Each type of reduction is as important and has its own place in the spectrum of climate solutions. We consider both equally important in combating climate change and reaching global carbon neutrality by 2050.

Understanding Carbon Removal

Removal credits focus on eliminating carbon already present in the atmosphere, a crucial step in addressing the excess emissions driving climate change. Activities that remove carbon can take multiple forms, including nature-based removals, such as reforestation, afforestation & revegetation as well as tech-based solution, including biochar.

Understanding Carbon Avoidance

Avoidance credits focus on avoiding future carbon from being released into the atmosphere. These projects typically involve activities such as protecting forests from deforestation, improving energy efficiency, or shifting to renewable energy sources. By reducing reliance on emission-intensive practices, avoidance projects help keep future greenhouse gases from entering the atmosphere.

Who Do We Support?

Whether you are an SME, mid-sized company, large corporation, beginner or already an expert, we tailor our support to your needs and level of maturity.

Businesses

Maturity Level

Multi-Sector

Simulate your Carbon Portfolio

Buying carbon credits through a portfolio approach means investing in a diverse mix of high-quality climate projects. Diversify your portfolio to reduce risks, boosts credibility and maximize impact.

Talk With an Expert for Free to Explain your Needs

Q&A

For more details, read our dedicated article

For a carbon credit to generate real change, it must meet strict criteria that guarantee credibility and measurable impact:

- Verification: Certified by independent bodies to ensure real CO2 reductions.

- Permanence: Reductions are durable and protected from reversal.

- Additionality: Projects prove they wouldn’t exist without carbon credit funding.

- Transparency: Traceable data builds stakeholder trust.

Through a rigorous selection of projects, some specialised organisations ensure that every contribution generates a tangible and credible impact, aligned with the highest industry standards. Contact us for more details.

Carbon credits are issued based on when emission reductions occur : either in the past or the future:

- Ex-post credits: These retrospective credits represent emission reductions that have already been achieved and verified.

- Ex-ante credits: These forward-looking credits, represent anticipated emission reductions that have yet to happen. Often used in projects like reforestation, they provide value in financing future emission reductions in long-term initiatives.

Both types of carbon credits play essential roles in mitigating climate change:

Ex-post credits provide verified, measurable reductions, guaranteeing that your contribution has an immediate and positive impact. The vintage year adds transparency by indicating exactly when the environmental benefit occurred.

Ex-ante credits are crucial for funding early-stage or ongoing carbon projects with high potential. By investing in these credits, you help scale solutions critical for long-term sustainability.

At ClimateSeed, we specialize in helping organizations build carbon credit portfolios that align with their climate strategies. Contact us for more details.

Carbon reduction projects can be grouped into two main categories: carbon removal and carbon avoidance projects.

Carbon removal is the elimination of existing carbon emissions, by absorption, after they have entered the atmosphere. Carbon removal projects can take place in two ways, either with the use of technology or done naturally. Examples include; enhanced rock weathering, biochar, agricultural land management, and blue carbon projects.

Carbon avoidance is the prevention of future carbon emissions being released into the atmosphere. Some examples include, renewable energy, household and community devices, such as cookstoves or biogas, and waste management.

They both can generate carbon credits and are equally important in the fight against climate change. For more information, read our dedicated article.

The key distinctions between the Voluntary Carbon Market (VCM) and the Regulated Carbon Market lie in their frameworks and participation. The VCM is voluntary, allowing companies and individuals to buy carbon credits to finance carbon removal and avoidance projects beyond legal requirements. The Regulated Carbon Market, on the other hand, is government-mandated, requiring companies to comply with emissions caps by purchasing allowances or credits under schemes like the EU Emissions Trading System (EU ETS). The VCM offers flexibility and broader project options, while the Regulated Market is more strictly controlled and enforced. For more information, read our dedicated article.

Interested in submitting your certified project?

70% of our project developers are long-term partners with whom we have collaborated for over 3 years.

Contact our expert team for an in-depth evaluation.