CSRD 2025 Definition: Understanding Non-Financial Reporting for EU Companies

CSRD Definition

The Corporate Sustainability Reporting Directive (CSRD) is a European directive adopted in 2022 to improve and expand the corporate sustainability reporting framework. It replaces the Non-Financial Reporting Directive (NFRD) of 2014 and introduces new requirements for companies, including the publication of detailed information on their environmental, social, and governance (ESG) performance.

According to the European Parliament, around 50,000 companies will be affected by the CSRD, compared to 11,000 under the NFRD. This directive aims to enhance transparency and facilitate the comparability of non-financial data across the European market.

In effect within the EU starting from January 2024, the Corporate Sustainability Reporting Directive (CSRD) strengthens and broadens the non-financial reporting framework previously established by the NFRD.

Hot news 2025: European Commission proposes to postpone and simplify the CSRD

Stop the clock ⏰

Member states’ representatives (Coreper) approved on March 26th the Council’s position (‘negotiating mandate’) on one of the Commission’s proposals to simplify EU rules and thus boost EU competitiveness. This proposal (the so-called ‘Stop-the-clock’ directive) postpones the dates of application of certain corporate sustainability reporting and due diligence requirements, as well as the transposition deadline of the due diligence provisions.

The proposal forms part of the ‘Omnibus I’ package adopted by the Commission at the end of February 2025 to simplify EU legislation in the field of sustainability. In view of significant implications for the business community, the Polish presidency has treated this proposal with utmost priority with the aim of providing EU companies with the necessary legal certainty as regards their reporting and due diligence obligations. Member states have broadly shared the presidency’s sense of urgency and, in that view, supported the Commission’s proposal to postpone:

- by two years the entry into application of the Corporate Sustainability Reporting Directive (CSRD) requirements for large companies that have not yet started reporting, as well as listed SMEs, and

- by one year the transposition deadline and the first phase of the application (covering the largest companies) of the Corporate Sustainability Due Diligence Directive (CSDDD).

Omnibus I, II and III

The European Commission has published a proposal (February 2025) to significantly modify the timeline and scope of the Corporate Sustainability Reporting Directive (CSRD). These changes, if adopted by the European Parliament and the Council, could significantly reduce the initial scope of the CSRD while maintaining the goals of the European Green Deal.

Key Elements of the "Omnibus" Proposal:

-

Two-Year Postponement for Waves 2 and 3: Large unlisted companies (Wave 2) would start reporting in 2028 (for the 2027 financial year) instead of 2026, and listed SMEs (Wave 3) in 2029 (for the 2028 financial year) instead of 2027.

-

Drastic Reduction in Scope: The Commission proposes to exclude approximately 80% of the initially targeted companies by raising the thresholds. Only companies with more than 1,000 employees (and either revenue exceeding €50 million or a balance sheet total over €25 million) would remain subject to reporting obligations.

-

Strengthening of the "Value-Chain Cap": Protection against excessive information requests would be extended to all companies with fewer than 1,000 employees, rather than only SMEs as currently defined.

-

Simplification of Standards: Sector-specific standards would be abandoned, with only simplified general standards retained.

-

Permanent Limited Assurance: The option to move to reasonable assurance would be removed, permanently maintaining the limited assurance level.

| Current CSRD | Omnibus Proposal | |

| Scope of application | Large companies (>250 employees) and listed SMEs | Only companies >1000 employees AND (Revenue >€50M OR balance sheet >€25M) |

| Timeline - Wave 2 | Reporting starting in 2026 (for the 2025 financial year) | Reporting starting in 2028 (for the 2027 financial year) |

| Timeline - Wave 3 | Reporting starting in 2027 (for the 2026 financial year) | Reporting starting in 2029 (for the 2028 financial year) |

| ESRS Standards | Complete set including sector-specific standards | Simplified standards, fewer data points, focus on quantitative data |

| Value Chain | Obligation to obtain data from all suppliers | Protection for companies <1000 employees (value-chain cap) |

Why does CSRD matter?

With its progressive entry into force since January 2024, the CSRD represents a major shift for European and international companies operating within the European Union. Its main objectives are:Expanding the number of companies subject to reporting obligations.

Standardizing reporting practices to ensure data comparability.

Increasing transparency on ESG impacts by establishing a structured framework through the ESRS standards.

In summary, the CSRD places sustainability at the core of corporate strategies by introducing clear requirements for large companies starting in 2024.

This article aims to highlight the main changes introduced by the CSRD compared to the NFRD and to provide a detailed overview of the reporting process, with a particular focus on the Climate Change Standard (ESRS E1).

Who is affected by the CSRD?

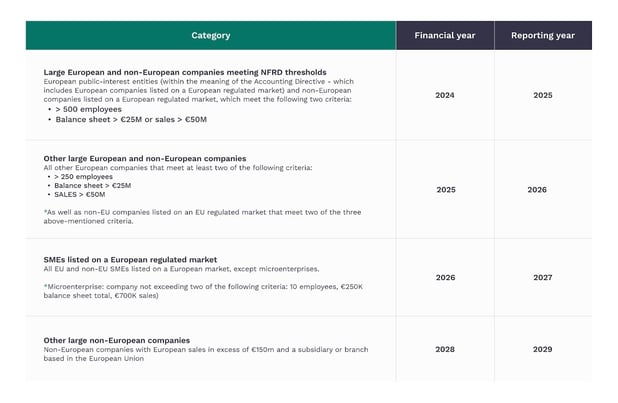

The CSRD applies to a wide range of European and non-European companies, with its implementation being phased in progressively from 2024 to 2028, depending on the category of the company.

Specifically, it will be applied in several phases:

- Starting in 2024, for large companies already subject to the NFRD.

- From 2025, for all other large European companies and certain international groups.

- From 2026, for SMEs listed on European markets.

- From 2028, for large non-European companies with significant operations in Europe.

Companies will thus benefit from a 1 to 3-year transition period, depending on their size and status, to help them adapt to these new requirements.

For detailed eligibility criteria and implementation timelines, download our comprehensive guide on the CSRD.

You will find more details in the following table:

Decree No. 2024-152 of 28 February 2024 on the adjustment of size criteria for companies and corporate groups, published in the Official Journal of the French Republic on 1 March 2024.

In addition, there would be a phasing-in period of between 1 and 3 years for certain information on the following issues: the financial impact of climate on the company; gender breakdown of employees; collective bargaining coverage; adequate wages; social protection; and training and skills development.

Update Ordinance no. 2023-1142 of December 6, 2023 on the publication and certification of sustainability information and the environmental, social and corporate governance obligations of commercial companies:

It is created in French law in order to achieve an effective transposition of the CSRD, the common definitions concerning company and group differences, which also anticipates the raising of the thresholds provided by the amended Accounting Directive (Directive 2013/34/EU), which will normally be applicable from January 1, 2024 (this will be confirmed on expiry of the 2-month period following notification of the delegated directive, i.e. December 18, 2023 (Article 7 of the Ordinance)). The implementation decree (Decree n°2023-1394 of the 30th of December 2024) has been published in France, For middle and big companies, balance sheet : 20M euros, turnover 40M euros et number of employees 250. For the big groups : balance sheet: 24M euros, turnover : 48M euros, and number of employees: 250. This needs to be followed up in each member state. As a reminder, the thresholds will be raised by 25% (e.g. for the Other Large European and non-European companies category, the balance sheet total will rise from 20 to 25 million euros and the sales figure from 40 to 50 million euros), which will have the effect of modifying the number of companies concerned by the CSRD requirements (e.g. reducing the number of companies qualifying as large companies).

What is the scope of the information required by the CSRD?

The general ESRS standards

The thematic scope of CSRD is deliberately broad, covering the environment, social aspects and governance (ESG). The expected information is specified and framed within the European Sustainability Reporting Standards (ESRS) developed by the European Financial Reporting Advisory Group (EFRAG). An initial set of twelve standards has been proposed by EFRAG.

Among these standards, ESRS 2 is the subject of a universal reporting obligation. All companies will be required to disclose both information and general principles. Reporting on standards that are not subject to a universal reporting obligation is subject to a double materiality analysis.

Beyond universal mandatory reporting, companies will have to define the relevance of additional ESRS standards according to the impact of the sustainability categories on their financial performance (financial materiality) and the impact of the company on the ESRS sustainability categories (impact materiality).

.png?width=3296&height=1928&name=MicrosoftTeams-image%20(111).png)

ESRS standards by reporting obligation (Source: EFRAG)

Focus on the climate change module

ESRS E1, which concerns climate change only: if a company concludes that climate change is not a material issue, and therefore does not report by this standard, it must provide a detailed explanation of the conclusions of its materiality assessment about climate change.

Reporting on ESRS 1 must respect the ESRS 2 elements and the methodology defined in ESRS 1.

.png?width=2400&height=1534&name=MicrosoftTeams-image%20(109).png)

ESRS E1 disclosures - Climate change

What are the main reporting requirements of the CSRD?

Double Materiality in the CSRD

The CSRD introduces a double materiality analysis, which requires companies to assess and report on:

- Impact materiality: The effects of the company's activities on sustainability.

- Financial materiality: The risks and opportunities that ESG issues pose to the company.

This concept ensures that companies provide a comprehensive view of their sustainability performance, addressing both outward impacts on society and the environment, and inward financial impacts on the business.

The following diagram illustrates the concept of double materiality under the CSRD:

.png?width=2048&height=1536&name=MicrosoftTeams-image%20(110).png)

Illustration of the principle of double materiality

A compulsory exercise in itself

ESRS 2 - General Information makes it universally mandatory to disclose material impacts, risks, and opportunities to a company's strategy and business model. It also makes it mandatory to describe the process by which companies identify and prioritize their Impacts, Risks, and Opportunities (IROs) indicators.

- An exercise that determines the reporting obligations of the companies concerned

As we have already seen, the CSRD is made up of universally mandatory standards and mandatory standards based on the materiality of the company concerned.

For example, a company with a material impact on water, or whose business model relies on water resources, is required to publish information relating to ESRS 2 - General Information.

.png?width=2048&height=1406&name=MicrosoftTeams-image%20(108).png)

Materiality-based reporting requirements for companies in the context of the CSRD

2. Reporting procedures

- Publication of information in the management report of companies, either in a consolidated section, or in four separate parts (general information, E, S, G), or by incorporation by reference (e.g. ESRS E1-1, paragraph 1)

Update December 6, 2023, Ordinance no. 2023-1142 of December 6, 2023, relating to the publication and certification of sustainability information and the environmental, social, and corporate governance obligations of commercial companies: In France, the ordinance modifies the rules relating to the DPEF (Extra-Financial Performance Declaration) to replace it with the obligation to publish sustainability information. Sustainability information will be even more substantial, to meet the CSRD's sustainability reporting requirements within the management report. - Digitization of the management report - including sustainability reporting (ESG statement) - and mandatory availability in an electronically readable format (XHTML), access to be defined locally.

- "Tagging of sustainability information within the European Single Access Point (ESAP), an IT portal due to go live at the end of 2024. Regulation (UE) of the 13th December 2023 published the 20th of December 2023 established the ESAP.

- Clarification of the responsibilities of management and governance bodies, including the audit committee (compliance, efficiency of internal control and risk management systems, digitalization, etc.).

3. Third-party verification

To ensure a high level of data quality, the CSRD will require third-party auditing of the data reported in the sustainability report. From 2025, limited assurance will be required. The European Commission will study the possibility of requiring reasonable assurance (a stronger form of audit) from 2028.

Specific insurance standards have yet to be drawn up by the European Commission. It has been established that EU member states may set their standards, provided they do not duplicate those of the Commission.

Directive 2006/43/EC on auditing has already established requirements for auditors who will be carrying out audits on behalf of a third party. The CSRD should include provisions enabling auditors qualified before 2024 to acquire the theoretical knowledge needed to carry out audits on the new types of reports.

The audit must be carried out by statutory auditors approved by the competent authority of the member country. However, legislation allows member states to authorize independent assurance service providers. Independent auditors must comply with the equivalent requirements specified in the Audit Directive 2006/43/EC.

Update December 6, 2023: CSRD transposition in France by ordinance: Ordinance no. 2023-1142 of December 6, 2023 on the publication and certification of sustainability information and on the environmental, social and corporate governance obligations of commercial companies.

Chapter 2 of the Ordinance specifies that third-party verification may be carried out by either a statutory auditor (whose obligations and rules have been modified) or an independent assurance provider (IAP). They will be supervised by the newly-created Haute Autorité de l'Audit (H2A), and will be required to undergo significant training.

4 Penalties

Update December 6, 2023: France being the first to transpose the CSRD has chosen sanctions that meet the following criteria: effective, proportionate, and dissuasive following the indications contained within the directive itself. These will encourage the companies concerned to move quickly to draw up their next sustainability reports.

First of all, it will be possible for any person to apply to the courts for the reports to be made available (subject to a fine) (article 10 of the Ordinance).

In the event of non-publication of the sustainability report, the companies concerned may be banned from accessing public procurement (calls for tender), possibly coupled with a fine (to be determined by decree).

Failure to audit sustainability information (article 15 of the Ordinance) will result in a fine of up to 30,000 euros and up to 2 years' imprisonment.

In the event of obstruction of the audit (article 15 of the Ordinance), the penalties will be more severe: a fine of up to 75,000 euros and up to 5 years' imprisonment.

How to Prepare for CSRD Reporting?

Achieving compliance with the CSRD may seem complex, but following these key steps will help companies navigate the transition effectively:

1. Assemble Your CSRD Task Force

The first step is to create a dedicated team responsible for the CSRD project. Ideally, this team should include employees with expertise in finance, environment, governance, and sustainability. Since the CSRD affects all areas of an organization, avoid limiting the team to one department. Instead, involve key decision-makers across different functions, such as company executives, legal officers, financial managers, and HR leaders.

2. Develop and Prepare a Double Materiality Analysis

One of the most significant new requirements introduced by the CSRD is the obligation to conduct a double materiality analysis.

This process involves:

- Engaging with all stakeholders.

- Covering the entire value chain.

- Considering the short-, medium-, and long-term impacts of the company’s activities.

Given the complexity and time-consuming nature of this analysis, companies are encouraged to use specialized technological tools to facilitate the evaluation and ensure reliable results.

3. Gain a Comprehensive Understanding of ESRS Standards

The European Sustainability Reporting Standards (ESRS) define the disclosure requirements across ESG topics.

A thorough understanding of these standards is crucial to ensure the company produces a structured, compliant, and relevant report.

4. Collect and Monitor Reliable Data

To meet CSRD requirements, companies must:

- Collect data on their emissions (Scope 1, 2, and 3) and other ESG indicators, involving suppliers and business partners.

- Establish rigorous processes for data collection and verification to ensure reliability and traceability.

This step is critical since ESG information will be subject to third-party assurance. Using a dedicated reporting software can streamline data collection and analysis, saving both time and resources.

5. Draft and Validate Your CSRD Report

To create your report, use a format that complies with the CSRD reporting standards: the European electronic format (XHTML).

Once the report is drafted, it must be submitted to an Independent Third-Party Organization (ITO).

This step ensures validation of the issues identified in your double materiality analysis, as well as verification of the reliability, credibility, and transparency of the data.

Conclusion

The CSRD sets higher standards for sustainability reporting, encouraging companies to adopt more transparent and responsible practices. Its impact will vary depending on the organization.

If needed, ClimateSeed’s experts are available to help you better understand these requirements. Feel free to contact us.

Check out our related article: Interoperability Goals Between CSRD and ISSB.

Sources:

https://www.legifrance.gouv.fr/jorf/id/JORFTEXT000049209674

https://entreprendre.service-public.fr/vosdroits/F38208

https://www.efrag.org/en

Share this

You May Also Like

These Related Stories

What’s Next for the CSRD and the Omnibus Package in October 2025?

ESRS E1: Understanding the CSRD's Climate Standard