GHG accounting, how to choose the right methodology to calculate your company's carbon footprint?

Table of contents

1. GHG Accounting: Comprehensive analysis and comparison of GHG accounting methodologies

2. The context behind GHG accounting

3. Which Methodology to Apply?

4. What is the difference between BEGES vs Bilan Carbone?

5. Towards efficient GHG accounting

6. How ClimateSeed can support you with your GHG accounting?

GHG Accounting: Comprehensive analysis and comparison of GHG accounting methodologies

The field of Greenhouse Gas (GHG) accounting has evolved significantly over the past few decades, becoming a cornerstone of corporate sustainability strategies worldwide. As climate change has risen to the forefront of global challenges, the need for standardized, reliable methods of measuring and reporting corporate CO2 emissions has never been more critical.

At ClimateSeed, our extensive experience in the field and close relationships with our clients have revealed that many companies are still struggling to keep up with the latest developments in GHG accounting methodologies.

One of the key challenges they face is determining which methodology is most appropriate for their specific situation, considering factors such as market, industry, and geographic location. To address this, we’ve created this article to clarify the main differences between various GHG accounting methodologies. Our goal is to provide clear, straightforward information and guidance to help organizations make informed decisions.

By comparing these methodologies in an easy-to-understand way, we aim to equip businesses with the tools they need to respond accurately and comprehensively to both regulatory and market demands in this ever-evolving sector.

The context behind GHG accounting

Historically, the development of GHG accounting methodologies has been driven by a combination of governmental regulations, international agreements, and private sector initiatives, all aimed at creating a uniform approach to emissions measurement.

One of the earliest and most influential developments in GHG accounting was the Kyoto Protocol, established in 1997, which set legally binding emission reduction targets for developed countries. This spurred the creation of various frameworks and standards by international bodies, including the International Organization for Standardization (ISO) with its ISO 14064 standard, and the World Resources Institute (WRI) and World Business Council for Sustainable Development (WBCSD) with the GHG Protocol. These initiatives laid the groundwork for what would become the globally recognized methodologies for GHG accounting.

In the private sector, numerous organizations and industry groups have also played a pivotal role in shaping the landscape of GHG accounting. The Carbon Disclosure Project (CDP), for instance, has been instrumental in encouraging companies to disclose their emissions and climate-related risks, while the Science Based Targets initiative (SBTi) provides companies with a clear pathway for aligning their GHG reduction targets with the goals of the Paris Agreement.

In recent years, there has been a marked increase in the regulatory requirements imposed on companies, particularly in Europe. The introduction of the Corporate Sustainability Reporting Directive (CSRD) and the Sustainable Finance Disclosure Regulation (SFDR) has signaled a shift towards mandatory reporting of not just financial key performance indicators (KPIs), but also those related to environmental, social, and governance (ESG) factors. Several countries also are opting to use voluntary reporting frameworks to create reporting requirements. For example, the International Financial Reporting Standard (IFRS) S2 climate-related disclosures standard is being adopted into regulatory frameworks in different countries around the globe.

These directives require companies to provide detailed accounts of their GHG emissions, making it imperative for organizations to adopt robust GHG accounting practices.

GHG emissions disclosure is a critical climate change mitigation and accountability tool, as well as a key step towards achieving ambitious emissions-reduction goals. To avoid the worst impacts of climate change, global greenhouse gas emissions need to drop by nearly half by 2030 and ultimately reach net zero according to the last indications provided in the IPCC Sixth Assessment Report. The process to achieve these GHG emissions reductions starts with GHG accounting.

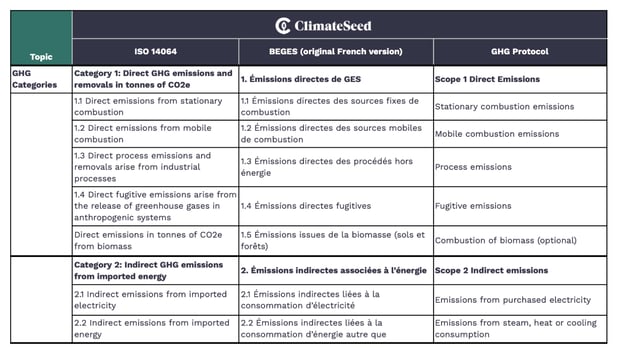

Within this evolving regulatory and operational context, three methodologies have emerged as the most widely used and recognized in Europe: ISO 14064, BEGES (specifically for the French market), and the GHG Protocol Corporate Standard. Each of these standards offers a unique approach to measuring and reporting emissions, catering to different organizational needs and regulatory frameworks. ISO 14064 provides a flexible framework adaptable to various sectors, BEGES aligns closely with French national regulations, and the GHG Protocol offers a comprehensive global standard focusing on Scope 1,2 and 3. The three methodologies have some similarities and touch points that will be explored in the table below.

Which Methodology to Apply?

When determining the most appropriate methodology for GHG accounting, companies of all sizes—whether large, medium, or small—must carefully evaluate several critical factors. These considerations include regulatory requirements, industry standards, stakeholder expectations, and strategic goals. In some cases, a company might even opt to apply multiple methodologies to ensure comprehensive coverage and compliance.

1. Regulatory Compliance

The primary driver for selecting a GHG accounting methodology is often regulatory compliance. In Europe, various directives and national laws require companies to measure and report their GHG emissions.

- ISO 14064: This international standard is recognized globally and can be applied across various regulatory environments. It is particularly useful for companies that operate in multiple jurisdictions, as it provides a flexible framework adaptable to different legal requirements.

- BEGES (Bilan d'Émissions de Gaz à Effet de Serre): This methodology is mandatory in France for companies with over 500 employees. It is specifically tailored to comply with French national regulations, making it essential for companies operating in or headquartered in France.

- GHG Protocol: Widely adopted globally, the GHG Protocol aligns with many international reporting initiatives such as the Carbon Disclosure Project (CDP) and the Science Based Targets initiative (SBTi). It is often required or preferred by multinational corporations and organizations involved in global supply chains.

2. Industry Standards and Competitiveness

Beyond regulatory requirements, industry standards often dictate the choice of GHG accounting methodology. Companies increasingly find that compliance with certain standards is a prerequisite for doing business, particularly in sectors where sustainability is a key competitive factor.

- ISO 14064: Given its international recognition, ISO 14064 can be crucial for companies bidding on international contracts or working with multinational clients. Being ISO 14064 certified can provide a competitive advantage by signaling a commitment to robust and transparent GHG accounting practices.

- GHG Protocol: The detailed and comprehensive nature of the GHG Protocol makes it especially valuable for companies involved in industries with complex supply chains or those looking to engage in voluntary climate initiatives. It is often seen as the gold standard for GHG accounting and is widely recognized by investors, clients, and other stakeholders. As a third party company, it is equally possible to certify an organization based on the GHG Protocol.

- BEGES: While BEGES is specifically focused on compliance within France, its thorough approach, particularly in aligning with French environmental policies, makes it an important tool for companies seeking to enhance their reputation within the French market or with French clients. As a third party company, it is equally possible to certify an organization based on the BEGES.

3. Customer and Stakeholder Expectations

Customer demands and stakeholder pressures are increasingly shaping corporate sustainability strategies. Companies are finding that transparency in GHG emissions reporting is not just about compliance but also about meeting the expectations of customers, investors, and other stakeholders.

- ISO 14064: By adopting ISO 14064, companies can provide assurance to stakeholders that their GHG emissions are being measured and reported according to a rigorous and internationally accepted standard.

- GHG Protocol: For companies whose clients or stakeholders are deeply engaged in sustainability, the GHG Protocol offers the most detailed and comprehensive reporting, particularly for Scope 3 emissions. This makes it an excellent choice for companies seeking to demonstrate leadership in sustainability.

- BEGES: For French companies or those with significant operations in France, complying with BEGES not only meets regulatory expectations but also aligns with the growing demand for localized, high-standard reporting within the French market.

4. Strategic Goals and Long-Term Sustainability Objectives

Finally, the choice of GHG accounting methodology should align with a company’s broader strategic goals, particularly in terms of sustainability and corporate social responsibility (CSR).

- ISO 14064: This standard is particularly well-suited for companies that seek flexibility in their GHG accounting and wish to integrate sustainability into their long-term strategic planning. ISO 14064 allows companies to tailor their approach based on their specific needs and growth objectives.

- GHG Protocol: Companies with ambitious sustainability goals, such as achieving net-zero emissions, often turn to the GHG Protocol due to its comprehensive coverage and global applicability. The GHG Protocol’s detailed guidance on Scope 3 emissions is particularly valuable for companies aiming to address their entire value chain’s impact.

- BEGES: For companies focused on national compliance and alignment with French sustainability goals, BEGES is a critical tool. It ensures that the company’s reporting is consistent with national strategies and can support broader CSR initiatives within France.

In the context of greenhouse gas (GHG) accounting, selecting the most appropriate methodology is a crucial decision that can significantly impact the accuracy, reliability, and comparability of an organization's emissions data. To provide a clearer understanding of the key options available, the following table presents a comparative analysis of the three main methodologies used mainly by European organizations. This table examines the critical elements of each methodology, highlighting their respective strengths, areas of application, and how they align with various regulatory and operational requirements. Such a comparison is essential for organizations aiming to enhance their GHG reporting processes and ensure compliance with both national and international standards.

What is the difference between BEGES vs Bilan Carbone?

Specifically, when discussing French regulation in the context of GHG accounting, we’ve noticed some confusion between two seemingly similar but distinct concepts: Bilan Carbone® and BEGES. Let's clarify these differences.

The BEGES, according to the regulatory methodology (V.5 July 2022), is described as "an internal management tool for developing and implementing relevant climate strategies." It is mandatory for many public institutions and private entities with over 500 employees in France.

If your company is subject to the Déclaration de Performance Extra-Financière (DPEF), which is the French transposition of the Non-Financial Reporting Directive (NFRD), you are not required to formalize a separate action plan following your BEGES (Bilan des Émissions de Gaz à Effet de Serre). This is because, under the DPEF, companies are already required to report on their GHG emissions as part of their broader sustainability reporting obligations. The DPEF includes detailed information on how companies manage and reduce their environmental impacts, including GHG emissions.

Whereas, if your company is not subject to the DPEF, and is not under the scope of the Article L. 229-25 of the French Environment Code it is still recommended to calculate your emissions across all three scopes using BEGES methodology.

To perform a BEGES, an organization can use the Bilan Carbone® method, which requires training provided by IFC (Institut Francais Carbone). BEGES measures the emissions, whereas the Bilan Carbone® refers to the method developed by ADEME (Agence de l'Environnement et de la Maîtrise de l'Énergie), Jean-Marc Jancovici, and the Association for Low Carbon Transition (ABC).

The Bilan Carbone® method is recommended because it is compatible with ISO 14064-1:2018 and ISO 14069:2013 standards for GHG emission quantification. This methodology goes beyond just evaluating GHG emissions; it is a comprehensive approach that includes raising awareness and developing an action plan to reduce emissions.

Towards efficient GHG accounting

Selecting an appropriate GHG accounting methodology is essential, nevertheless initiating a reporting process and developing internal capabilities is deemed to be a very crucial part of the process. Building robust expertise in non-financial data collection and analysis is essential for accurate GHG reporting.

Additionally, exchanging knowledge and best practices with peers can enhance understanding and implementation. If necessary, seeking guidance from specialized external bodies can ensure that the organization is well-equipped to meet regulatory requirements and effectively manage its sustainability initiatives.

Once GHG emissions are calculated, it is crucial to embark on a decarbonization journey to actively reduce emissions. This approach not only ensures compliance but also strengthens the organization’s ability to adapt to future regulatory challenges and enhances the accuracy and comprehensiveness of its sustainability reporting over time.

How ClimateSeed can support you with your GHG accounting?

At ClimateSeed, we understand the challenges that organizations face when navigating the various methodologies and regulatory requirements for GHG accounting. That's why in addition to our consulting support, we have developed an innovative digital platform designed to simplify this process.

GEMS, our platform allows companies to measure their emissions comprehensively and accurately, offering results across the three key methodologies such as ISO 14064, the GHG Protocol, and BEGES. What sets our solution apart is its ability to tailor the results based on the specific approach selected. Whether your organization needs to comply with international standards, meet specific national regulations, or explore all possible frameworks, our platform provides the flexibility to generate precise reports according to your chosen methodology.

By leveraging our platform, companies can gain a holistic view of their carbon footprint, ensuring that they meet compliance obligations while also identifying opportunities for improvement. This multi-approach capability not only saves time and reduces the complexity of emissions reporting but also empowers organizations to make informed decisions that align with their sustainability goals.

We invite you to explore how our digital solution can support your GHG accounting needs and provide the clarity and confidence necessary to navigate the evolving regulatory environment. Visit our website to learn more and see how ClimateSeed can help you on your journey toward a more sustainable future.

Share this

You May Also Like

These Related Stories

The GHG Protocol: The Global Reference for Carbon Accounting

What is the Environmental Impact of the Food Industry?

.webp?width=600&height=829&name=Download%20Guide%20measure%26reduction%20EN%20(1).webp)